Interdisciplinary project between CSCS and University of Lugano on Computational Finance funded by Swiss National Science Foundation

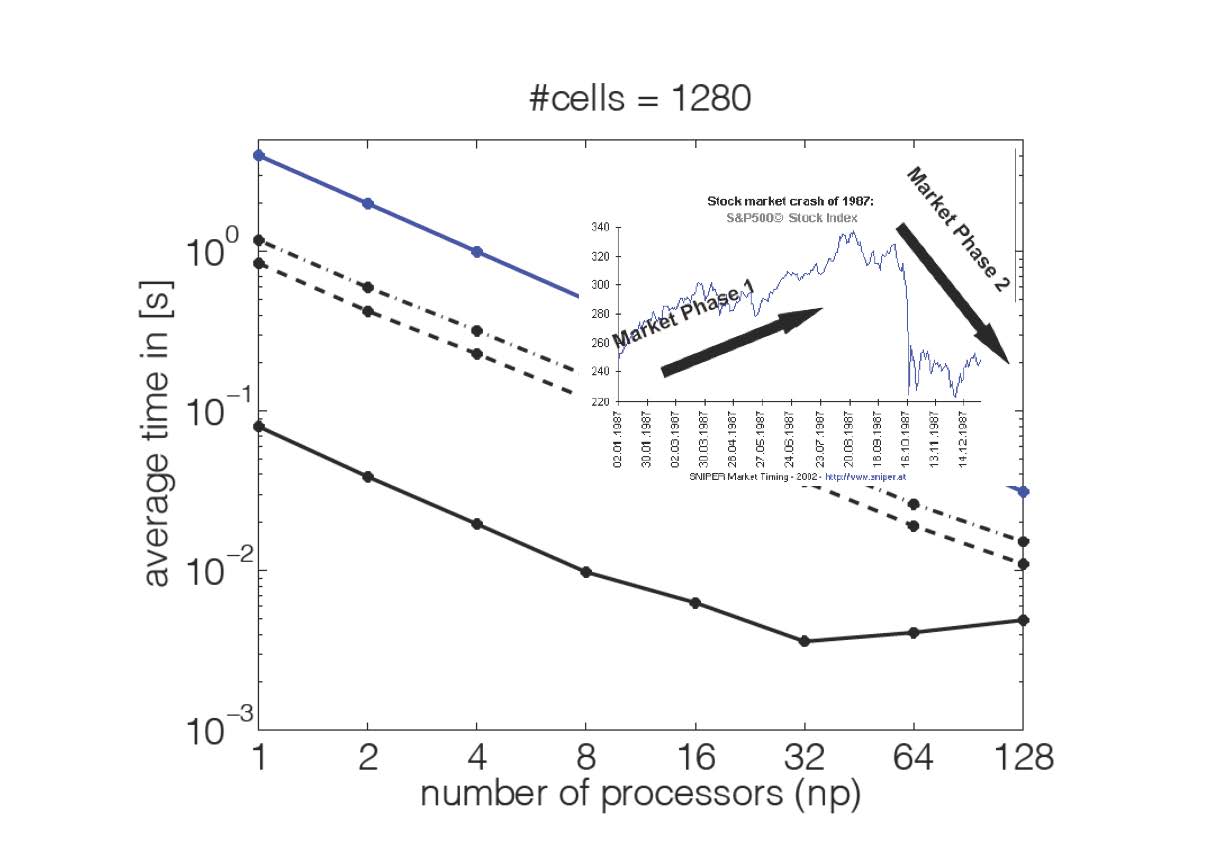

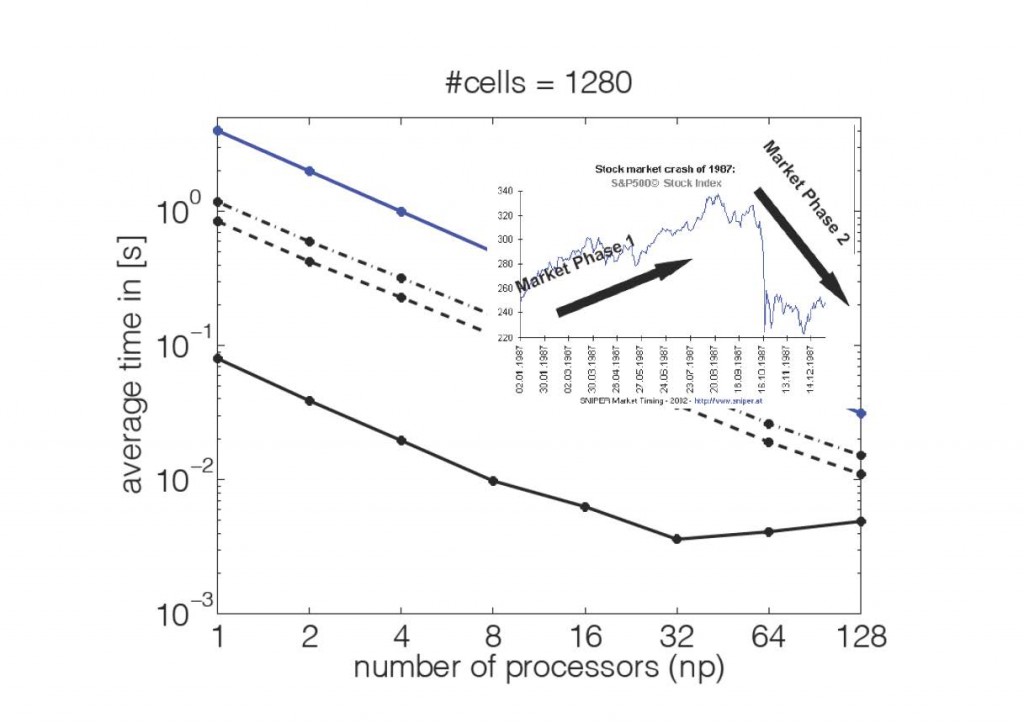

Analysis and prediction of financial risks, such as market and credit risks, is one of the central problems in modern economy. An adequate understanding of the available risk data requires advanced mathematics and refined high performance numerical algorithms. A pilot study carried out at the Institute for Computational Science at the University of Lugano (USI) in 2011-2012 on the CSCS XE6 illustrated great promise of such techniques running on supercomputers.

In order to weave together the necessary disciplines to address this global challenge, Profs. Illia Horenko (Institute of Computational Science) and Patrick Gagliardini (Department of Economics) joined forces with CSCS (represented by Dr. William Sawyer), in a proposal to the Swiss National Science Foundation (SNF) to develop new high performance algorithms for time series analysis for parameterizing the risks. The algorithm development will go hand-in-hand with the implementation and comparison on high-performance platforms at CSCS.

The resulting algorithms will be applied to available financial databases for identification of statistically significant regional and global financial inter-dependencies. From these the team hopes to extract the significant external factors influencing the Swiss economy.

Recently the SNF approved the proposal and will fund two PhD students at USI for 3 years. These students will be interact closely with CSCS while developing the risk analysis software.